salt tax deduction wikipedia

According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

Salt Cap Workarounds Will They Work Accounting Today

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse.

. This means you can deduct no more than. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for married taxpayers filing. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state.

The federal tax reform law passed on Dec. 52 rows The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or. Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for.

The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The SALT deduction is one of the largest federal tax expenditures as it costs the federal government trillions of dollars in lost revenue. In New York the.

What Is the State and Local Tax SALT Deduction. The SALT deduction has been a part of our federal income tax since 1913. As part of its tax reform efforts Congress has discussed whether to eliminate the ability for taxpayers to deduct state and local taxes SALT.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a. From Wikipedia the free encyclopedia. The SALT deduction allows taxpayers who itemize their filings to deduct the cost of state and local taxes theyve paid over the course of the past year including both property.

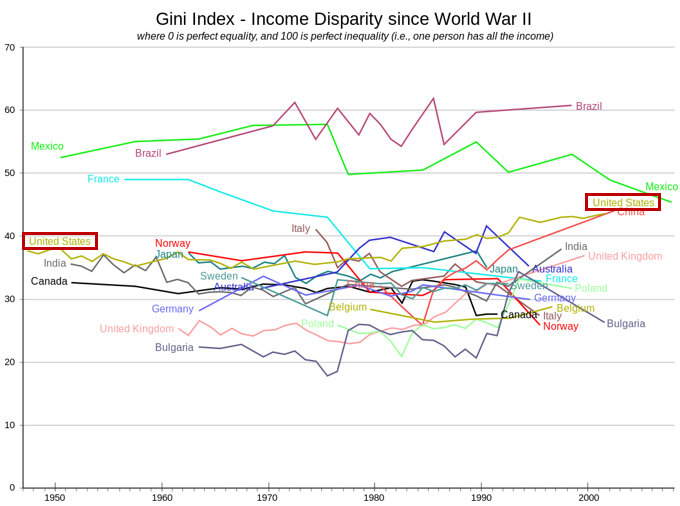

53 rows The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments.

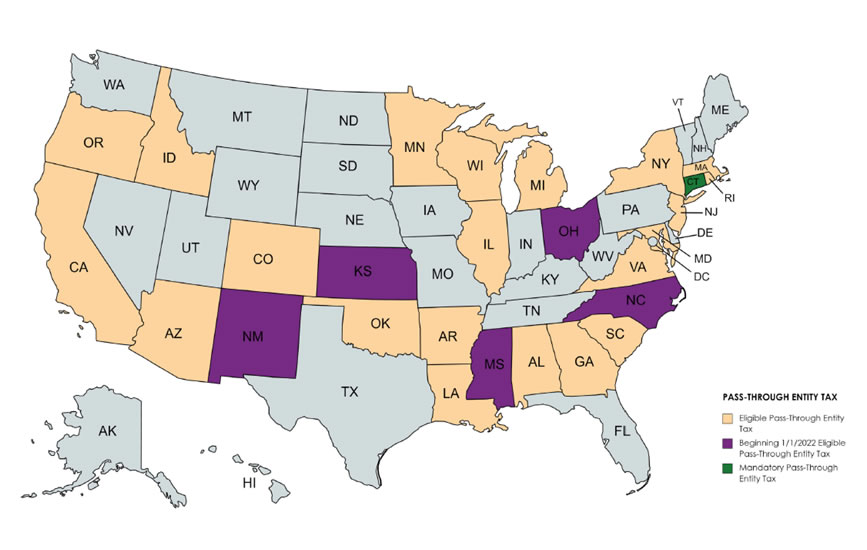

Pass Through Entity Tax Treatment Legislation Sweeping Across States Forvis

When Prostitutes Service Secret Service Are They Tax Deductible

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Transfer Pricing Enforcement Is Increasing How To Defend Your Transfer Pricing Mgo

If You Can T Beat Em Join Em The Rise Of The 501c4 On The Left Non Profit News Nonprofit Quarterly

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

Gabrielaltay Hacdc Wikipedia Datasets At Hugging Face

Nj Governor Signs New Laws That May Impact Your Business Or Non Profit Alloy Silverstein

Is Median Household Income Based On Gross Wages Or Net Wages Quora

Tax News Views Great Billionaire And Pumpkin Roundup

Maryland S Salt Workaround Impacts And Planning Opportunities Buchanan Ingersoll Rooney Pc

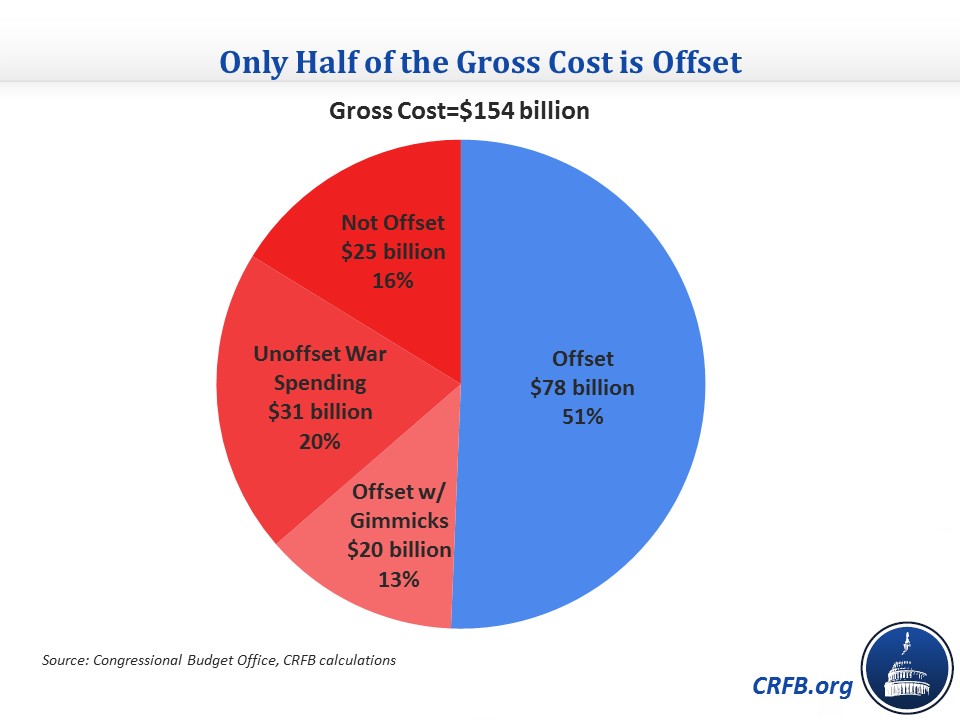

Budget Deal Truly Offsets Only Half Its Cost Committee For A Responsible Federal Budget

California S Workaround To The Federal Cap On State Tax Deductions Mgo

Planned Giving North Carolina Wildlife And Outdoor Recreation Foundation